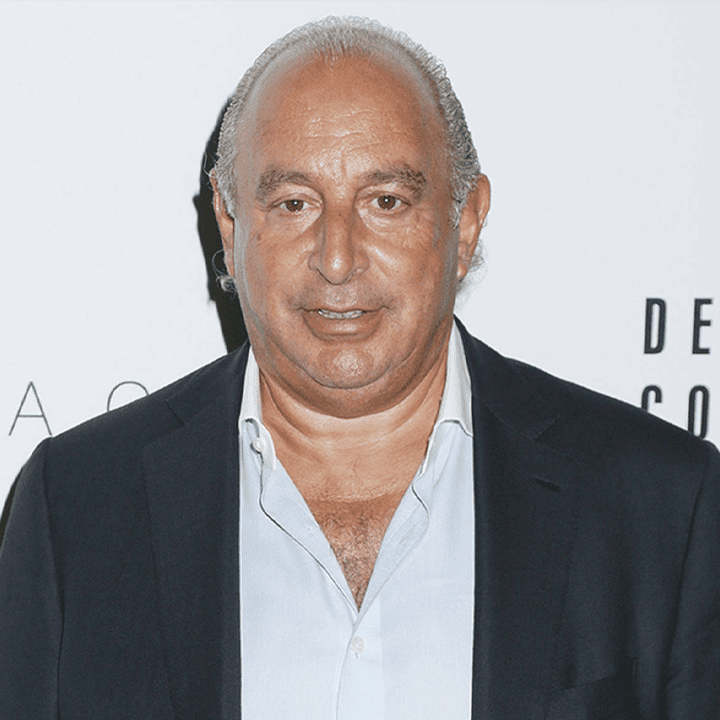

Philip Green Net Worth

$2.4 Billion

- Category: Richest Business › Richest Billionaires

- Net Worth: $2.4 Billion

- Birthdate: Mar 15, 1952 (72 years old)

- Birthplace: Croydon

- Gender: Male

- Profession: Businessperson, Entrepreneur

- Nationality: United Kingdom

What is Philip Green's net worth?

Philip Green is a British businessman with a fortune of 2.4 billion dollars. He is currently the CEO of Arcadia Group, a large retail giant that includes brands such as Topshop, BHS and Dorothy Perkins.

Green dropped out of school at 15 to work as a shoe importer. In this position, he traveled throughout the US, Europe and the Far East, which inspired him to start his own business. Back in the UK, Green borrowed £20,000 to set up his first deal to import jeans to sell to retailers in London.

In 1979, Green began buying up large inventories of designer clothing from stores that had gone out of business. He opened his own store from which he sold clothes.

In 1988, Green became chairman of Amber Day, a discount retailer listed on the London Stock Exchange. Over time, he bought several competing chain stores, including Owen Owen and Olympus Sports. Green made a good deal with the latter, which he sold to JJB Sports for £550 million three years after buying it. He rose to fame in 1999 with a hostile takeover attempt of Marks and Spencer, which was blocked by the board of directors of Britain's best-known store chain. But that didn't stop him from acquiring British Home Stores (BHS) for £200 million a year later. Unfortunately, in 2015, he was forced to sell BHS for just £1.

In 2002, Philip and his wife Tina acquired Arcadia Group, which owned a number of chains including TopShop, Top Man, Miss Selfridge, Burton and Dorothy Perkins.

In 2005, Philip initiated a $2.1 billion lump sum dividend payment to his wife.

Business decline: In November 2020, Arcadia Group was forced into bankruptcy due to the COVID-19 pandemic.

All net worth data is based on publicly available information. Where appropriate, we also use private recommendations and testimonials from celebrities or their representatives. While we strive to maximize the accuracy of our calculations, these figures are approximate unless otherwise noted. We welcome any corrections and feedback, use the button below.